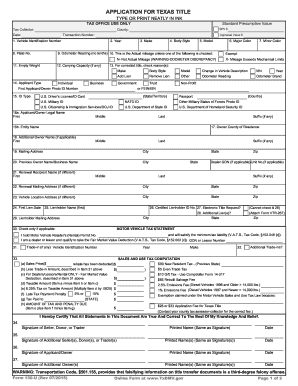

FL LCPA 501 2019-2026 free printable template

Show details

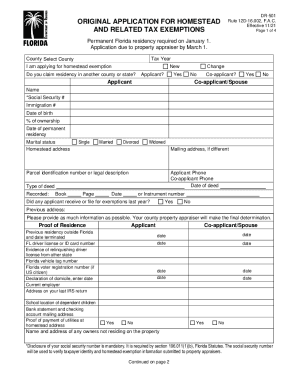

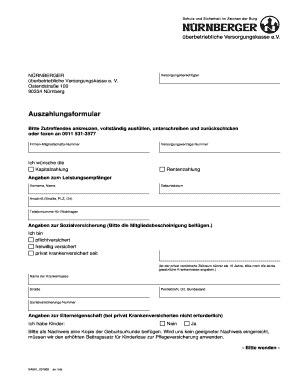

Exemption Instructions and Application

Returncompletedapplicationto: LakeCountyPropertyAppraiser

Attn:ExemptionsDepartment

320 W. Main St. Suite A

Tavares,FL327783831

NOTE: The deadline to file is

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign port saint lucie homestead application form

Edit your port st lucie homestead application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your homestead exemption port st lucie form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit port st lucie homestead exemption online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit st lucie county homestead exemption form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL LCPA 501 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out homestead port st lucie form

How to fill out FL LCPA 501

01

Obtain a copy of the FL LCPA 501 form from the appropriate source or website.

02

Fill in the designated fields with your personal information, including your name, address, and contact details.

03

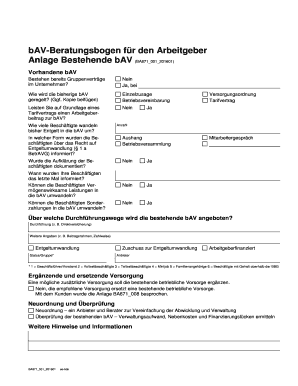

Provide any necessary financial information as requested on the form.

04

Review the instructions accompanying the form for any specific requirements pertaining to your situation.

05

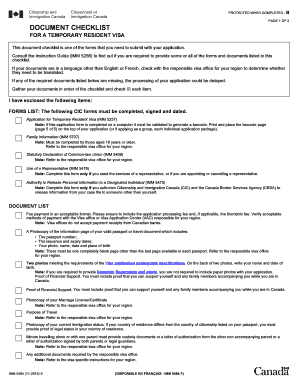

Check for any supporting documents that may need to accompany the form, such as identification or proof of income.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the filled-out form through the designated method (e.g., online, mail, in-person) as instructed.

Who needs FL LCPA 501?

01

Individuals or entities seeking to file a claim or apply for programs related to the LCPA in Florida.

02

Persons who meet the eligibility criteria outlined in the LCPA guidelines.

03

Anyone who requires financial assistance or legal protections as specified in the LCPA policies.

Fill

st lucie homestead exemption

: Try Risk Free

People Also Ask about homestead exemption st lucie county online application

Where can I find the form to homestead your house in Florida?

The application for homestead exemption (Form DR- 501) and other exemption forms are on the Department's forms page and on most property appraisers' websites. Submit your homestead application to your county property apprsaiser.

Who qualifies for Florida homestead exemption?

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

How do you homestead in St Lucie County?

You must meet the following requirements as of January 1st of the qualifying tax year: Have legal or beneficial title to the property, as recorded in the Official Records of Saint Lucie County. In good faith make the property your permanent residence. Be a permanent resident of the State of Florida.

What documents are needed for Florida homestead exemption?

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

What is the homestead exemption for Port St Lucie Florida?

A major exemption in Florida is the Homestead Exemption, which is up to $50,000 on a primary residence. There also are property tax discounts based on age, disability or veteran status.

How do I file for homestead exemption in Florida?

The application for homestead exemption (Form DR- 501) and other exemption forms are on the Department's forms page and on most property appraisers' websites. Submit your homestead application to your county property apprsaiser. Click here for county property appraiser contact and website information.

Does Port St Lucie have homestead exemption?

A major exemption in Florida is the Homestead Exemption, which is up to $50,000 on a primary residence. There also are property tax discounts based on age, disability or veteran status.

Can I apply for the Florida homestead exemption online?

Filing for the Homestead Exemption can be done online. Homeowners may claim up to a $50,000 exemption on their primary residence.

How do I file a homestead exemption in St Lucie County Florida?

You may file your application online or in person at one of our 2 convenient locations. The filing deadline is March 1st of the tax year for which you are applying. However, pre-file applications are accepted during the year.

What do I need to file for homestead exemption in Florida?

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send homestead exemption st lucie county for eSignature?

When your florida homestead exemption application online is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit st lucie county homestead exemption application on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share florida homestead exemption application from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete st lucie county homestead application on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your florida homestead exemption, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is FL LCPA 501?

FL LCPA 501 is a form used in Florida for the reporting of certain financial information by local governments and other entities required to comply with the Local Government Financial Reporting laws.

Who is required to file FL LCPA 501?

Entities such as counties, municipalities, special districts, and other local governmental units in Florida are generally required to file the FL LCPA 501 form.

How to fill out FL LCPA 501?

To fill out FL LCPA 501, entities must provide accurate financial information as required, including details about revenues, expenditures, assets, and liabilities, following the instructions provided with the form.

What is the purpose of FL LCPA 501?

The purpose of FL LCPA 501 is to ensure transparency and accountability in local government financial practices by requiring standardized reporting of financial data.

What information must be reported on FL LCPA 501?

The form must report information including total revenues, total expenditures, changes in fund balances, and other financial data relevant to the local government's financial status.

Fill out your FL LCPA 501 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Homestead Exemption Florida is not the form you're looking for?Search for another form here.

Keywords relevant to port saint lucie homestead exemption

Related to florida lcpa 501 exemption lake county get

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.